In the ever-fluctuating world of finance, the stock market’s recovery can often feel like a delicate dance, with investors eagerly waiting for the right steps to be taken. Just like a skilled conductor harmonizes an orchestra, this article aims to objectively analyze historical patterns, economic factors, and government policies that influence the stock market’s recovery timeline.

Drawing from expert predictions and offering strategies for investors, this data-driven exploration seeks to provide clarity to those seeking a sense of belonging in the intricate realm of stock market recovery.

Key Takeaways

- Stock market recovery can be influenced by various factors such as market volatility, investor sentiment, and economic indicators.

- Government policies play a crucial role in stabilizing the economy and restoring investor confidence during a stock market recovery.

- Investment experts have different opinions on the timeline of stock market recovery, which can be influenced by market volatility and investor sentiment.

- Investors should implement careful risk management strategies, diversify their investment portfolio, and stay updated with market trends to maximize returns during the recovery period.

Historical Patterns of Stock Market Recovery

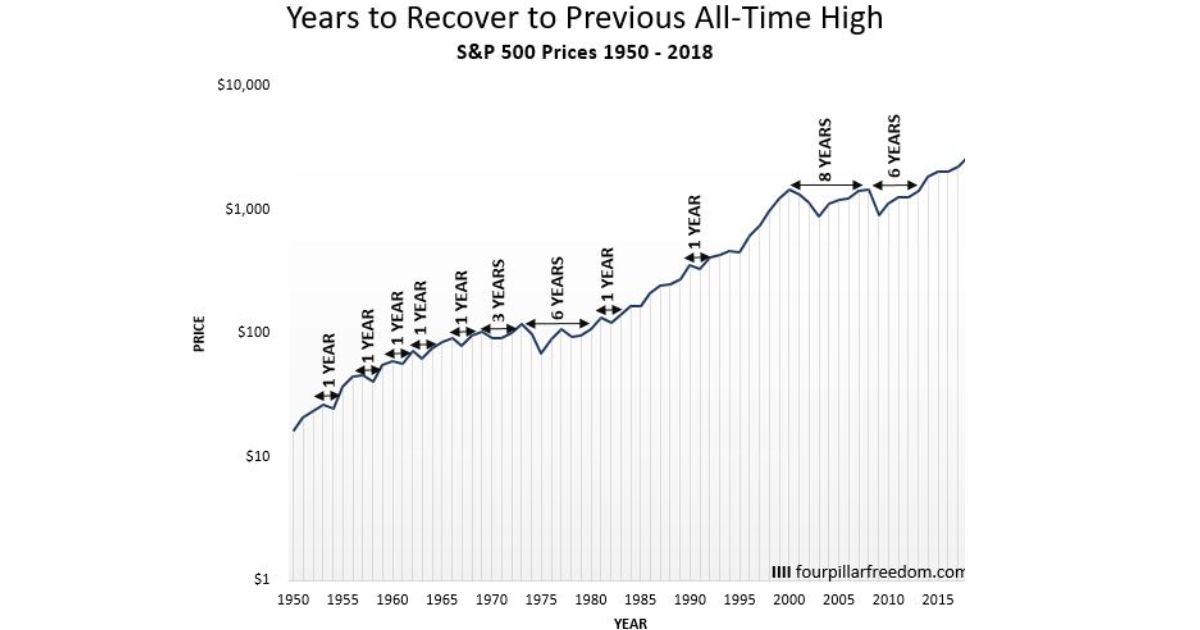

While there is no definitive answer, examining the historical patterns of stock market recovery can provide insights into potential timelines for recovery. Market volatility and investor sentiment play significant roles in determining the duration of the recovery. Historical data shows that the stock market has experienced various levels of volatility throughout its existence.

During periods of high volatility, such as economic crises or major geopolitical events, the recovery process may be more prolonged. Investor sentiment also plays a crucial role in determining the speed of stock market recovery. Positive sentiment can lead to increased buying activity and a faster rebound, while negative sentiment can prolong the recovery period.

Understanding these historical patterns and their impact on market recovery can help investors make informed decisions. Transitioning into the subsequent section on the impact of economic factors on stock market recovery, it is important to consider how these factors interact with market volatility and investor sentiment.

Impact of Economic Factors on Stock Market Recovery

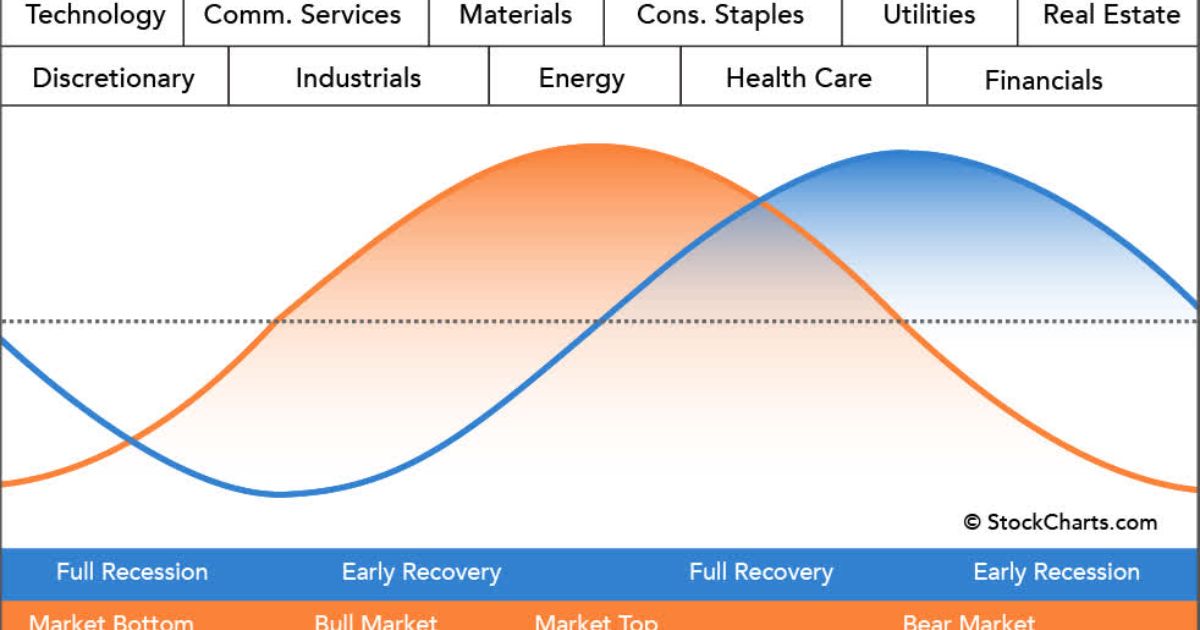

One key factor that can significantly influence the speed and trajectory of stock market recovery is the impact of various economic factors. Market volatility and investor sentiment play crucial roles in determining how quickly the stock market can bounce back from a downturn.

Market volatility refers to the degree of price fluctuations in the market, and it can be influenced by factors such as economic indicators, political events, and global trends. Investor sentiment, on the other hand, refers to the overall mood and confidence of investors in the market.

Positive investor sentiment can lead to increased buying activity and help boost stock prices. Conversely, negative sentiment can result in selling pressure and a prolonged recovery period. Therefore, analyzing and understanding these economic factors is essential for predicting and preparing for stock market recovery.

Role of Government Policies in Stock Market Recovery

Government policies play a crucial role in facilitating the recovery of the stock market, as they can implement measures to stabilize the economy and restore investor confidence. Government intervention in times of market turmoil can have a significant impact on the stock market’s recovery process.

Regulatory measures such as imposing trading restrictions, implementing stimulus packages, and providing financial assistance to struggling industries can help restore stability and encourage investment. These policies can create a sense of security and reassurance for investors, leading to increased market participation and improved market sentiment.

Government support can have a positive spillover effect on other sectors of the economy, further contributing to the overall recovery. The table below highlights some examples of government policies and their potential impact on stock market recovery:

| Government Policy | Potential Impact on Stock Market Recovery |

|---|---|

| Trading restrictions | Can prevent panic selling and stabilize market |

| Stimulus packages | Injects liquidity into the economy and boosts investor confidence |

| Financial assistance | Supports struggling industries and prevents market collapse |

Expert Predictions on Stock Market Recovery Timeline

Investment experts have differing opinions on the timeline for stock market recovery. While some predict a swift rebound, others believe it will take a longer time to fully recover. The market volatility during the recovery period is a key factor influencing these predictions.

As the market tries to stabilize, fluctuations in stock prices can continue, making it difficult to determine a precise timeline for recovery. Investor sentiment also plays a crucial role in the recovery process. If investors remain optimistic and confident in the market’s ability to bounce back, it can expedite the recovery.

If fear and uncertainty persist, it may prolong the timeline for recovery. Ultimately, the timeline for stock market recovery remains uncertain and is subject to various factors, including market volatility and investor sentiment.

Strategies for Investors During Stock Market Recovery

Implementing careful risk management strategies and staying informed about market trends can help investors navigate the stock market during its recovery. During this time, investors should consider various investment opportunities that arise.

It is essential to diversify the investment portfolio to mitigate risks and maximize potential returns. Staying updated with market trends and conducting thorough research on companies can help identify undervalued stocks that may offer significant growth prospects.

Furthermore, setting realistic goals and maintaining a long-term perspective can help investors avoid making impulsive decisions based on short-term market fluctuations. The table below highlights some strategies that investors can consider during the stock market recovery.

| Strategy | Description |

|---|---|

| Diversification | Spreading investments across different asset classes to reduce risk |

| Dollar-cost averaging | Regularly investing a fixed amount of money, regardless of market conditions |

| Value investing | Identifying undervalued stocks based on fundamental analysis and potential for future growth |

| Stop-loss orders | Setting predetermined sell orders to limit potential losses |

| Staying informed | Continuously monitoring market trends, news, and company performance to make informed decisions |

Conclusion

In conclusion, the timeline for stock market recovery remains uncertain due to the complex interplay of historical patterns, economic factors, and government policies. While experts offer predictions, the irony lies in the fact that the stock market’s recovery timeline is inherently unpredictable.

Investors should adopt strategies that are informed by data and analysis to navigate the uncertain waters of stock market recovery. Ultimately, the market’s recovery will unfold in its own time, defying any definitive expectations.