In the tumultuous world of investing, the thought of a stock market crash can send shivers down the spines of even the most seasoned investors. For those who have diligently saved for retirement through individual retirement accounts (IRAs), the question of what happens to their hard-earned money in such a scenario looms large.

This article delves into the historical impact of stock market crashes on IRAs, explores the relationship between stock market performance and IRA value, and provides strategies to safeguard your IRA during turbulent times.

Key Takeaways

- Stock market crashes can have a significant impact on the performance and value of IRAs.

- Diversifying portfolios can help mitigate the negative impact of stock market crashes on IRAs.

- IRA values typically decline during market crashes due to the decrease in overall stock market value.

- Strategies such as diversification, staying informed, and adjusting the portfolio based on market conditions can help safeguard IRAs during stock market crashes.

Historical Impact of Stock Market Crashes on IRAs

Throughout history, the occurrence of stock market crashes has had a significant impact on the performance and value of IRAs. These crashes have the potential to greatly affect retirement savings and can have long-term effects on individuals’ financial well-being.

When the stock market experiences a crash, the value of investments held within IRAs can plummet, resulting in a decrease in the overall value of the account. This can be particularly devastating for individuals who are nearing retirement age and have limited time to recover from the loss.

The impact on retirement savings can be further compounded by the long-term effects of a stock market crash, as it may take years for the market to fully recover and regain its previous levels. Therefore, it is crucial for individuals to carefully consider their investment strategies and diversify their portfolios to mitigate the potential negative impact of stock market crashes on their IRAs.

Understanding the Relationship Between Stock Market Performance and IRA Value

Understanding the relationship between stock market performance and IRA value is crucial for investors. When the stock market crashes, it can have a direct impact on the value of an IRA. However, it is important to note that the performance of an IRA is not solely dependent on the stock market, as it can be diversified across various asset classes to mitigate risk and protect against market downturns.

IRA and Market Crashes

As the stock market performance directly impacts the value of an IRA, it is crucial to analyze the relationship between the two during market crashes. Historical trends suggest that during market crashes, the value of IRAs typically declines due to the decrease in the overall stock market value.

The extent of the decline depends on various factors such as the diversification of the IRA portfolio and the severity of the market crash. It is important to note that while market crashes can lead to temporary declines in IRA value, it is not necessarily a permanent loss.

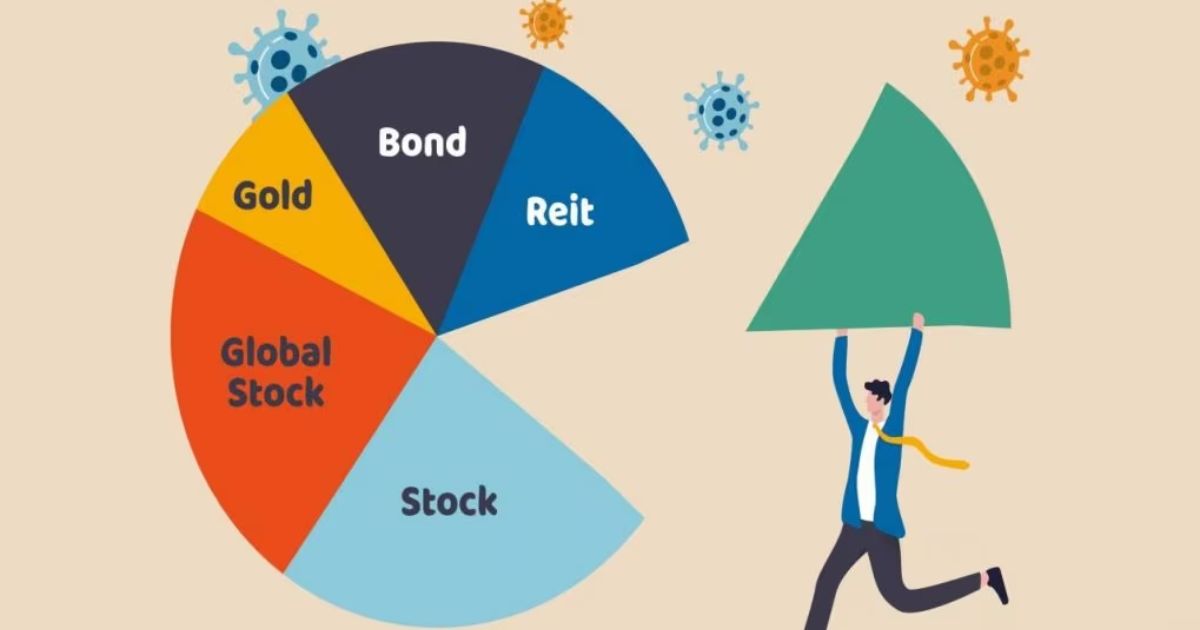

Over time, the market tends to recover and regain its value. To mitigate the impact of market crashes on IRAs, investors can consider diversifying their investment options, including bonds, real estate, and other asset classes to reduce overall risk.

Protecting IRA During Crashes

To safeguard an IRA during stock market crashes, investors should closely monitor the relationship between stock market performance and IRA value, and take appropriate measures to protect their investments. One of the key factors to consider is market volatility.

During periods of high market volatility, IRA values can fluctuate significantly. It is important for investors to be aware of this and have a strategy in place to mitigate potential losses. One approach is diversification, which involves spreading investments across different asset classes, such as stocks, bonds, and real estate.

This can help to reduce the impact of a market crash on the overall IRA value. Additionally, investors may consider investing in more stable assets, such as government bonds or gold, which tend to hold their value during market downturns. By being proactive and staying informed, investors can protect their IRA investments during stock market crashes.

Strategies to Safeguard Your IRA During a Stock Market Crash

Effectively safeguarding your IRA during a stock market crash necessitates implementing prudent investment strategies. One of the key strategies for long-term growth is to diversify your portfolio. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can reduce the impact of a stock market crash on your overall portfolio.

Another important strategy is to stay informed about market trends and economic indicators. This will enable you to make informed decisions about when to buy or sell investments, and to adjust your portfolio accordingly.

By staying informed, you can better navigate the ups and downs of the stock market and potentially mitigate losses during a crash. Transitioning into the next section, diversification is your key to weathering stock market volatility.

Diversification: Your Key to Weathering Stock Market Volatility

Diversification is a crucial strategy for investors looking to weather stock market volatility. By spreading investments across different asset classes and industries, investors can minimize the risk associated with any single investment.

The benefits of diversification include reducing the impact of a stock market crash on an IRA and potentially increasing the chances of achieving long-term investment goals. Implementing strategies for portfolio diversification, such as asset allocation and regular rebalancing, can help investors navigate market fluctuations and protect their IRA.

Benefits of Diversification

One major advantage of diversification is that it allows investors to spread their risk across multiple assets, reducing the impact of a stock market crash on their overall portfolio. By diversifying their investments, investors can benefit from the following:

- Protection against market volatility: Diversification helps to mitigate the impact of a stock market crash by spreading investments across different asset classes, such as stocks, bonds, and real estate. This can help to protect against significant losses in any one particular investment.

- Potential for higher returns: Diversification allows investors to take advantage of different investment opportunities and potentially earn higher returns. By diversifying their portfolio, investors can benefit from the performance of different sectors or industries that may outperform others during a market downturn.

- Reduced risk of loss: By spreading their investments across different assets, investors can reduce the risk of significant losses in the event of a stock market crash. This can help to preserve their capital and provide a more stable long-term investment strategy.

- Peace of mind: Diversification provides investors with peace of mind knowing that their portfolio is not solely reliant on the performance of a single investment. This can help to alleviate anxiety during periods of market volatility and provide a sense of security in their overall investment strategy.

Minimizing Stock Market Risk

To effectively mitigate stock market risk and navigate through periods of volatility, investors must prioritize diversification by allocating their investments across a range of different asset classes and industries. By spreading investments across various sectors, investors can minimize the impact of a stock market crash on their portfolio.

Diversification is a long-term investment strategy that involves spreading investments across different types of assets, such as stocks, bonds, real estate, and commodities. This strategy helps to reduce the overall risk by not putting all eggs in one basket. To further illustrate the importance of diversification, consider the following table:

| Asset Class | Percentage Allocation |

|---|---|

| Stocks | 50% |

| Bonds | 30% |

| Real Estate | 10% |

| Commodities | 10% |

As shown, the investments are diversified across multiple asset classes, reducing the vulnerability to market volatility. This strategy allows investors to take advantage of potential gains from different sectors while minimizing the impact of any individual sector’s downturn. In the next section, we will explore specific strategies for portfolio diversification.

Strategies for Portfolio Diversification

When considering strategies for portfolio diversification, it is important to carefully evaluate the various asset classes and industries in order to effectively weather stock market volatility. Diversifying your portfolio can help reduce risk and protect your investments during market downturns. Here are four strategies for portfolio diversification:

- Asset Allocation: Allocate your investments across different asset classes, such as stocks, bonds, and cash, based on your risk tolerance and investment goals.

- Geographic Diversification: Invest in a mix of domestic and international markets to reduce the impact of regional market volatility.

- Sector Diversification: Spread your investments across different industries to avoid concentration risk and minimize the impact of any one sector’s performance.

- Portfolio Rebalancing: Regularly review and rebalance your portfolio to maintain your desired asset allocation and adjust for changes in market conditions.

In addition to traditional investments, consider alternative investments like real estate, commodities, or hedge funds to further diversify your portfolio. By implementing these strategies, you can better navigate stock market volatility and protect your investments.

The Role of Asset Allocation in Protecting Your IRA From Market Turbulence

Investors must understand the importance of asset allocation in protecting their IRAs from market turbulence. Proper asset allocation involves spreading investments across different asset classes, such as stocks, bonds, and cash, based on an investor’s risk tolerance and financial goals. This strategy helps to mitigate the impact of market volatility on the overall portfolio.

Rebalancing is a crucial aspect of asset allocation. It involves periodically adjusting the portfolio to maintain the desired asset allocation mix. This ensures that the investor’s risk exposure remains in line with their objectives. Additionally, it is essential to consider the impact of inflation on IRA value.

Inflation erodes the purchasing power of money over time, and if not accounted for, can significantly affect the value of an IRA. Therefore, investors should review their asset allocation periodically and make necessary adjustments to protect their IRAs from market turbulence and inflation.

Seeking Professional Advice: How Financial Advisors Can Help Navigate Stock Market Crashes

Financial advisors play a crucial role in providing guidance and support to individuals seeking assistance in navigating stock market crashes. Here are four key benefits of seeking professional advice during market downturns:

- Emotional support: Financial advisors understand the emotional toll that market crashes can have on investors. They provide reassurance and help clients stay focused on long-term goals, preventing impulsive decisions driven by fear or panic.

- Expertise and knowledge: Financial advisors have extensive knowledge of market trends, investment strategies, and risk management techniques. They can analyze market conditions and devise personalized strategies to protect portfolios during a crash.

- Diversification and asset allocation: Advisors can help diversify investment portfolios across different asset classes and sectors, reducing the impact of a market crash on overall returns. They also adjust asset allocations based on market conditions to mitigate risk.

- Rebalancing and opportunistic investing: Advisors continuously monitor portfolios and rebalance asset allocations to maintain the desired risk-return profile. During market crashes, they identify opportunities to invest in undervalued assets for potential long-term gains.

Frequently Asked Questions

Can I Lose All of My Money in My IRA if the Stock Market Crashes?

There are tax implications if the stock market crashes, but it does not necessarily mean you will lose all your money in your IRA. Continuing contributions and diversifying your investments can help mitigate potential losses.

What Happens to My IRA if I Have Invested in Individual Stocks That Become Worthless During a Market Crash?

During a market crash, if the individual stocks in your IRA become worthless, there may be tax implications. It is important to consider withdrawal strategies and consult with a financial advisor to mitigate potential losses.

Are There Any Tax Implications for My IRA if the Stock Market Crashes?

Tax implications may arise for your IRA if the stock market crashes. It is important to understand how market downturns can affect your retirement savings and consult with a financial advisor to navigate potential tax consequences.

Can I Continue Contributing to My IRA During a Stock Market Crash?

During a stock market crash, it is generally advisable to continue contributing to your IRA. While the market may experience short-term volatility, contributing during a crisis can lead to long-term benefits and potential gains when the market recovers.

Is It Better to Withdraw Money From My IRA During a Stock Market Crash or Wait for the Market to Recover?

When considering withdrawal strategies during a stock market crash, it is important to weigh the long term vs short term impacts. Waiting for the market to recover may be a prudent choice, but individual circumstances should be carefully evaluated.

Conclusion

In conclusion, navigating a stock market crash can be a daunting task for IRA holders. However, by understanding the historical impact of market crashes, the relationship between stock market performance and IRA value, and implementing strategies such as diversification and seeking professional advice, investors can safeguard their IRAs during turbulent times. Just as a sturdy ship weathers a storm at sea, a well-protected IRA can endure market volatility and emerge stronger in the long run.