Looking to dive into the world of silver investments? Wondering what the price of silver is on the market today? Well, you’ve come to the right place. In this article, we’ll explore the current state of the silver market and provide you with all the information you need to make an informed decision. From historical trends to factors affecting prices, we’ll break it down for you. So, sit back, relax, and let’s unravel the mysteries of silver prices together.

Key Takeaways

- The price of silver is influenced by economic conditions, supply and demand, and geopolitical events.

- Silver prices tend to increase during times of economic uncertainty and decrease during strong economic performance.

- Fluctuations in production and consumption, as well as changes in industrial demand, can impact the overall availability of silver.

- Investor sentiment and market volatility play a significant role in determining silver prices.

Historical Trends: Understanding the Price of Silver Over Time

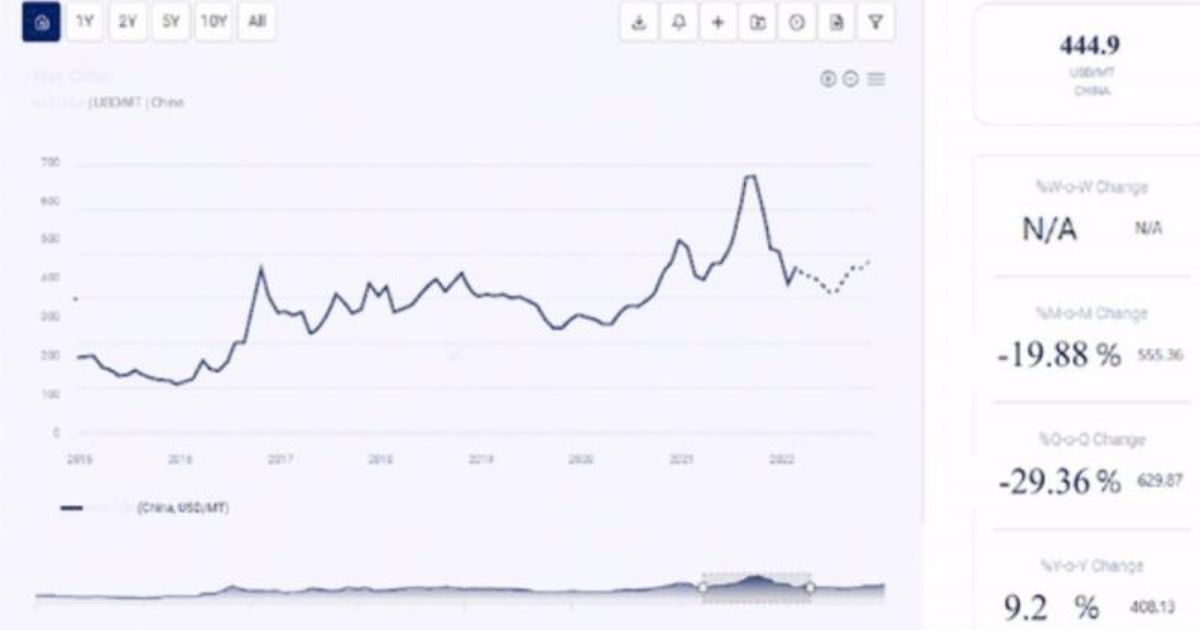

You should start by analyzing the fluctuating prices of silver throughout history. Understanding historical trends is crucial in analyzing the market forecast for silver. The price of silver has shown a pattern of ups and downs over the years, influenced by various factors such as economic conditions, supply and demand, and geopolitical events.

By studying past price movements, you can gain insights into potential future trends. For example, during times of economic uncertainty, silver tends to be seen as a safe haven investment, leading to increased demand and higher prices.

On the other hand, when the economy is performing well, silver prices may experience a decline as investors shift their focus to riskier assets. Analyzing historical trends can help you make informed decisions and navigate the silver market more effectively.

Factors Affecting Silver Prices: What Drives the Market Today

When looking at the factors that affect silver prices in the market today, there are several key points to consider. Supply and demand dynamics play a significant role, as fluctuations in production and consumption can impact the overall availability of silver.

Economic indicators, such as inflation rates and interest rates, also come into play, as they can influence investor sentiment and demand for silver as a safe-haven asset. By understanding these factors, investors can gain insights into what drives the market and make informed decisions regarding silver investments.

Supply and Demand

In today’s market, understanding the factors affecting silver prices is crucial to determining what drives the market. Supply and demand play a significant role in the price fluctuations of silver. When the demand for silver exceeds the available supply, the price tends to rise.

On the other hand, when the supply of silver surpasses the demand, the price tends to fall. Market dynamics, such as economic conditions, geopolitical factors, and investor sentiment, also influence silver prices. For example, during times of economic uncertainty, investors often turn to silver as a safe haven, driving up demand and subsequently its price.

Changes in industrial demand, particularly in sectors like electronics and solar energy, can impact the overall supply and demand balance, affecting silver prices. Understanding these market dynamics is essential for investors and traders to make informed decisions in the silver market.

Economic Indicators

One of the key economic indicators that can significantly impact silver prices is inflation. When the inflation rate is high, the value of the currency decreases, leading investors to seek alternative investments like silver. The relationship between inflation and silver prices can be understood through the following points:

- Preservation of purchasing power: Silver is often seen as a hedge against inflation, as it tends to hold its value better than fiat currencies during times of economic uncertainty.

- Economic growth: As economies grow, the demand for industrial applications of silver, such as in electronics and solar panels, increases. This can drive up the price of silver due to higher demand.

- Market sentiment: Investors often turn to silver as a safe haven asset during times of economic turmoil. This increased demand can push up silver prices.

Understanding these economic indicators can help investors make informed decisions about the price of silver in the market today.

Investor Sentiment

Do you know which factors drive the market today and affect silver prices? One crucial factor is investor sentiment. Investor sentiment refers to the overall attitude and outlook of investors towards the market. When investor sentiment is positive, it tends to drive up demand for silver, leading to an increase in prices.

Conversely, when investor sentiment is negative or uncertain, it can result in a decrease in demand and lower prices. Another factor that influences silver prices is market volatility.

High levels of market volatility can create fluctuations in silver prices, as investors may seek out safe-haven assets like silver during times of uncertainty. Understanding investor sentiment and market volatility is essential for analyzing and forecasting silver prices.

Now, let’s move on to the next section and delve into the market analysis, current trends, and forecast for silver prices.

Market Analysis: Current Trends and Forecast for Silver Prices

When analyzing the current trends and forecast for silver prices, it’s crucial to follow a structured approach like the “Marketing Research Process.” These steps include defining the problem, gathering data, conducting analysis, and making informed decisions. In addition to these steps, there are several factors to consider, such as market demand and supply, which play a significant role in understanding silver price fluctuations.

The projected silver price is an important aspect to examine within the marketing research process in order to understand where the market is heading. By taking into account these factors and following the marketing research process, one can gain valuable insights into the future direction of silver prices.

Factors Affecting Silver Prices

You should be aware of several factors that can affect the prices of silver in the market today. These factors include:

- Macroeconomic factors: Economic conditions, such as inflation, interest rates, and the overall state of the global economy, can significantly impact the price of silver. For example, during times of economic uncertainty, investors tend to flock to safe-haven assets like silver, driving up its price.

- Geopolitical events: Political tensions, conflicts, and instability in different parts of the world can also influence silver prices. Geopolitical events can disrupt the supply of silver or create uncertainty, leading to increased demand and higher prices.

- Market sentiment: The overall sentiment and perception of investors towards silver can greatly affect its price. Factors such as investor confidence, market speculation, and the demand for silver in industries like technology and solar energy can all contribute to fluctuations in silver prices.

Projected Silver Price

To accurately predict the future price of silver, you must carefully analyze current market trends and fluctuations. The projected future price of silver is influenced by various factors, including price volatility. Understanding these factors can help investors make informed decisions and plan their investments accordingly. Here is a table summarizing the current trends and forecast for silver prices:

| Current Trends | Forecast for Silver Prices |

|---|---|

| Increasing industrial demand | Steady rise in prices |

| Geopolitical tensions | Potential price spikes |

| Economic uncertainty | Fluctuations in prices |

Market Demand and Supply

Understanding the market demand and supply for silver can provide valuable insights into current trends and forecast for silver prices. Here are three key factors to consider:

- Market Volatility: Silver prices are influenced by market volatility, which refers to the rapid and significant price fluctuations. This volatility can be caused by various factors such as economic uncertainty, geopolitical tensions, and changes in investor sentiment. It is important to monitor market conditions and news to anticipate potential price movements.

- Price Manipulation: The silver market has faced allegations of price manipulation in the past. This refers to the deliberate attempt to influence the price of silver by large traders or financial institutions. Such manipulation can distort the market and impact silver prices. It is crucial to be aware of any potential manipulation and its effects on the market.

- Supply and Demand: The balance between supply and demand plays a significant role in determining silver prices. Factors such as industrial demand, investment demand, and mining production can influence the supply and demand dynamics. Understanding these factors and their impact on the market can help in forecasting silver prices.

Considering these factors, it is important to analyze the global demand and supply to gain a comprehensive understanding of how it impacts silver prices today.

Global Demand and Supply: How It Impacts Silver Prices Today

Understanding global demand and supply and how it impacts silver prices today is crucial for investors. The global economic impact plays a significant role in the volatility of silver prices. When the global economy is strong and growing, there is usually an increase in industrial demand for silver.

This can lead to higher prices as the demand outweighs the supply. On the other hand, during periods of economic uncertainty or recession, the demand for silver may decrease, resulting in lower prices. Additionally, global supply factors such as mining production and recycling rates also influence silver prices.

Higher mining production can lead to increased supply and potentially lower prices, while lower recycling rates can limit the available supply and drive prices higher. Therefore, staying informed and monitoring global demand and supply trends is essential for investors looking to understand and predict silver price movements.

Investing in Silver: Is It a Good Time to Buy

Are you considering investing in silver, but wondering if now is a good time to buy? Here are three reasons why now may be a great opportunity to invest in silver:

- Buying Opportunities: The recent dip in silver prices presents a buying opportunity for investors. When prices are low, it is an ideal time to enter the market and potentially benefit from future price increases.

- Long Term Potential: Silver has shown a strong long-term potential for growth. Its demand in various industries, such as electronics and solar energy, continues to increase. This sustained demand suggests that silver prices could rise over time.

- Diversification: Investing in silver allows you to diversify your investment portfolio. By adding silver to your portfolio, you can reduce risk and increase the potential for higher returns.

Considering these factors, it may be a good time to buy silver. Now, let’s explore how silver compares to other precious metals in today’s market.

Comparing Silver to Other Precious Metals: How Does It Stack up in Today’s Market?

Wondering how silver stacks up against other precious metals in today’s market? When comparing silver to gold, it is important to consider various factors. Historically, gold has been considered a safe haven asset, often sought after during times of economic uncertainty.

It tends to hold its value well and is often seen as a hedge against inflation. On the other hand, silver is known for its industrial uses, making it more susceptible to market volatility. While silver may experience larger price fluctuations compared to gold, it also has the potential for greater returns.

Silver has a lower price point compared to gold, making it more accessible for investors with a limited budget. Ultimately, the choice between silver and gold depends on your investment goals and risk tolerance.

Frequently Asked Questions

What Is the Current Price of Silver on the Market Today?

Factors affecting the price of silver and current trends in silver prices can provide valuable insights. Knowing the market conditions and staying informed about these factors will help you make informed decisions about investing in silver.

How Does the Historical Price of Silver Compare to Other Precious Metals?

When comparing the historical prices of silver to other precious metals, such as gold and platinum, it is clear that silver has experienced fluctuations and trends unique to its market.

What Factors Influence the Price of Silver on a Day-To-Day Basis?

Factors such as supply and demand, economic conditions, and investor sentiment influence the day-to-day price of silver. The volatility of these factors can cause fluctuations in the price, making it important to stay informed.

How Does Global Demand and Supply Affect the Price of Silver Today?

Understanding how global demand and supply impact the price of silver today is crucial. Factors like economic growth, industrial demand, and the state of the silver mining industry all play a role in determining its value.

Is Investing in Silver a Safe Option for Long-Term Financial Growth?

Investing in silver can be a safe option for long-term financial growth. By diversifying your investment portfolio and following sound investing strategies, you can potentially benefit from silver’s value appreciation. However, it’s important to consider potential risks.

Conclusion

In conclusion, the price of silver on the market today is influenced by various factors such as historical trends, global demand and supply, and market analysis. While investing in silver can be a good option, it is essential to consider its performance compared to other precious metals. By understanding these dynamics, you can make informed decisions and navigate the ever-changing silver market with confidence.